Understanding & Receiving Aid

Understanding & Receiving Aid

I am sure you are wondering what happens next after applying, and have questions about what to expect when it comes to receiving and understanding your aid offer. We have created this space with those questions in mind to help you understand next steps and timelines for aid at Carolina. While there will be some waiting time in between applying for aid and being admitted, to receiving your aid offer, it never hurts to be prepared and to know what to expect next.

Understanding Aid Offers & Billing

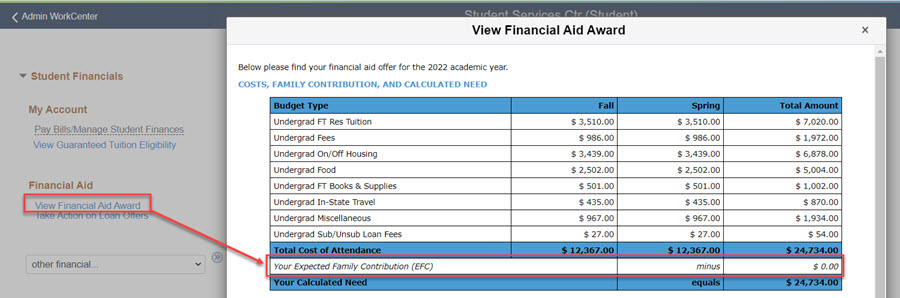

Estimated Family Contribution (EFC) is the term that is used to measure your family’s financial strength and is determined through your FAFSA application. This isn’t a number that you will receive a bill for or have to pay but instead is a figure that we use to determine how much financial aid you can be offered. You can find your EFC on your student aid report (SAR) that you receive electronically after submitting the FAFSA. Once you have been offered aid you can find your EFC on your aid offer.

The Cost of Attendance (COA) will serve as your estimated budget as a student. Schools are required to establish a cost of attendance based on average student costs to determine how much a student may need in funding each year in which they attend. It also serves as the threshold for total aid a student can receive. We are unable to offer aid over the COA total. The COA includes estimates for tuition, fees, housing, food, books/supplies, travel, miscellaneous expenses and loan fees. There is a COA for resident and non-residents given the difference in costs. A summary of the items in COA can be found below:

- Tuition: Based on the average tuition rate for either resident or non-resident students. Actual tuition charges may vary slightly from the budgeted amount. You can find actual tuition rates on the cashier’s website.

- Fees: Learn more about the types of fees, how and why they are assessed on the cashier’s website.

- Housing: The amount of housing in your budget is based on your FAFSA response. Housing categories include:

- On/Off-Campus Housing:

- The amount budgeted for either on-or-off campus is the same unless you have dependents you support

- If you live on-campus you will be billed by the university at the start of the semester

- If you live off-campus you will pay charges directly based your rent/lease agreement

- Living With Family

- With Dependents and/or Children

- If you live on-campus you will be billed by the university at the start of the semester

- If you live off-campus you will pay charges directly based your rent/lease agreement

- On/Off-Campus Housing:

- Food: The budgeted amount you may expect to spend on food, the value of this budget item is based on if you will be living on/off-campus, with family, or have dependents. Food categories include:

- On/Off-Campus & With Dependents

- The value of this budget item is based on the unlimited meal plan and covers at least three meals per day. This does not mean you have to use the meal plan.

- If you enroll in a meal plan you will be directly billed by the university at the start of the semester, if not you will pay for your food directly on your own.

- The value of this budget item is based on the unlimited meal plan and covers at least three meals per day. This does not mean you have to use the meal plan.

- Living With Family

- On/Off-Campus & With Dependents

- Books & Supplies: The average amount you can expect to spend, this will not be on your bill unless you ask to bill books through student stores.

- Travel: An amount that you may expect to spend to travel to and from school during breaks and in-between semesters.

- Miscellaneous: A catch all for the other expenses you may have while in school, this could be anywhere from a bottle of shampoo to toothpaste.

- Loan Fees: Included in the budget whether you borrow loans or not. Because loan fees are taken out of borrowed loans, this is here to account for that for student borrowers.

We being to process financial aid for returning students in mid-January.

- If we need additional documentation, you will receive an email notifying you of items on your ‘To Do’ list in your ConnectCarolina Student Center. On the right side in Student Center click ‘Financial Aid Items’ for additional information.

- If we do not need any additional information you will receive an email to your UNC issued email letting you know you can view your aid offer in your ConnectCarolina Student Center.

- Please keep in mind that it can take up to three weeks to process and review documentation. Your ‘To Do’ list will show a received status when we receive the document, and a complete status when it has been reviewed.

It isn’t! The description of COA in the question above outlines the parts of that budgeted COA. Again, those are estimated expenses and won’t be your exact billed charges. The only things that will appear on your bill are:

- Actual Tuition

- Actual Fees

- On-Campus Housing (if you live on campus)

- Food (if you enroll in a meal plan)

- Books (if you bill through student stores)

- Student Blue Insurance (if you do not waive by showing proof of insurance)

- Insurance is not a part of the regular COA budget, if you are enrolling in student blue or self-paying for insurance (not on a family members plan) you can request a budget increase for that expense on our forms page.

Great question, and it helps to plan ahead! We have built a budgeting calculator that mimics the billing process. You will use your aid offer for the single semester along with the budgeting calculator and get an estimate of additional amount owed after aid is applied, or if you will get a refund to use for your non-billed expenses.

Borrowing loans is an individual decision and will depend on your needs. We encourage you to borrow only what you need to be successful. You can use the budgeting calculator tool on our website to determine what your billed expenses will look like.

Another great resource is the Consumer Financial Bureau Protection Website, that tool is built to help you:

- Understand your financial aid offer

- Plan to cover the remaining costs

- Estimate how much you’ll owe and if you can afford that debt

- Compare offers from different schools

- Decide what to do next

Returning students should apply for aid for the upcoming year beginning October 1. We will not process aid applications or request additional documents until we begin processing for the upcoming year (typically in early February).

- We will send notification of your financial aid offer to your UNC email. The email will include instructions on how to view your offer in your ConnectCarolina Student Center.

- If you haven’t received your financial aid offer and have applied by mid-February, be sure to check your ‘To Do’ list for missing items.

- If you receive a request for additional items, it can take one-to-two weeks from the time we receive each item to clear it from the ‘To Do’ list. Once we receive all requested items, a final review will take place, aid will be processed, and we will send an aid offer via email.

Receiving Offered Aid

Financial aid is generally disbursed 7 to 10 days before the first day of the semester. Once aid is disbursed, it will go directly to your student account with the University Cashier and be applied to your charges.

If you notice that your aid has not been applied to your account within a week before classes begin, there may be additional action required on your part. Common reasons for not receiving disbursement include:

- You were approved to enroll full-time but are not enrolled in 12 hours.

- You are taking an approved underload but haven’t completed the Underload Adjustment Request Form with our office.

- You haven’t completed the loan requirements on your ‘To Do’ list for your loans.

- You have additional holds that need addressing. Any holds will be displayed in your Connect Carolina Student Center.

Once aid is applied, any aid in excess of charges will be refunded to you; refunds will be processed around the first day of classes. The quickest way to receive your refund is to set up direct deposit with the University Cashier. If you have not selected direct deposit you must email or go in person to the cashier to request and collect your refund check.

You can defer your bill and extend your due date with the University Cashier in ConnectCarolina. Please note: Campus Health charges, library fines and charges from a prior semester cannot be deferred.

Deferments requests must be submitted before the due date on the first bill of each semester.

To defer your bill:

- Log in to ConnectCarolina and access the Student Center through Self Service.

- In the Student Financials section, select Request Deferment from the drop-down menu.

- Click/check the box for Financial Aid Deferment and the Statement of Understanding and click submit.

- Click OK at the confirmation screen. You must request the deferment before the due date on the billing statement.

- The new due date will be displayed in the Account Activity section of the Student Center.

Once the new due date is less than 30 days away, the balance will show as DUE NOW instead of FUTURE DUE.

If you notice that your aid has not been applied to your account within a week before classes begin, there may be additional action required on your part. Common reasons for not receiving disbursement include:

- You were approved to enroll full-time but are not enrolled in 12 hours.

- You are taking an approved underload but haven’t completed the Underload Adjustment Request Form with our office.

- You haven’t completed the loan requirements on your ‘To Do’ list for your loans.

- You have additional holds that need addressing. Any holds will be displayed in your Connect Carolina Student Center.

Resources & Tools

Built to mimic a per semester bill, a great way to find out if you will owe a bill or receive a refund:

A tool built to help:

- Understand your financial aid offer

- Plan to cover the remaining costs

- Estimate how much you’ll owe and if you can afford that debt

- Compare offers from different schools

- Decide what to do next