How To Apply

How To Apply

Aid Eligibility

Federal aid is a primary source of paying for college for many students. There are specific requirements that you need to meet to receive federal and University aid, and this page can help walk you through that process.

Here are the requirements to be eligible for aid:

- Be accepted for enrollment into a degree program

- Meet deadlines in completing aid applications and additional requested documents

- Be a U.S. citizen or eligible non-citizen (permanent resident)

- Enroll full-time in coursework for program unless otherwise approved for part-time or underload status

- Maintain satisfactory academic progress

- Not be in default of prior federal loans or required grant repayments

When continuing to work on your first undergraduate degree you will be considered for several types of aid based on your aid applications. Financial aid can come in the form of federal grants, university grants and scholarships, work-study and loans.

Application Process

You’ll need to complete both the Free Application for Federal Student Aid (FAFSA) and CSS Profile to apply for financial aid at UNC-Chapel Hill.

FAFSA Instructions:

- Complete the FAFSA using UNC-Chapel Hill’s school code: 002974.

- Obtain your FSA ID, which serves as a digital signature to complete the FAFSA and sign electronically. Parents wishing to sign electronically will also need an FSA ID. If a parent is not eligible to receive an FSA ID, they can print and sign the signature page.

- The FSA ID will be used for future years. Be sure to keep track of your information.

- Visit the federal website to determine which parent to use on the FAFSA. For questions regarding dependency status, see here.

Need help completing your 2023-2024 FAFSA? Returning students can schedule an assistance appointment with a peer counselor using the button below.

CSS Profile Instructions:

Returning students do not need to complete the CSS Profile, as long as you remain enrolled and do not have a significant change in your financial situation.

- If you have left school and returned, you may need to complete the CSS Profile using UNC-Chapel Hill’s school code: 5816. College Board offers a tutorial to walk you through the CSS Profile.

- If you have had a change in your family’s financial situation and did not previously qualify for University aid with the CSS Profile, you can choose to complete a new CSS Profile for consideration. Contact us to let us know if you have completed a new CSS Profile.

aid restrictions

Restrictions on financial aid apply if you are:

- Seeking a second bachelor’s degree

- If you have already earned a bachelor’s degree, you will only be eligible for federal loans. The amount of loan eligibility will depend on loan limits and dependency.

- Enrolled in a certificate program

- Aid eligible certificate programs are limited to:

- Radiography

- Aid eligible certificate programs are limited to:

- Not seeking a degree

- If you are admitted with non-degree seeking status, you are not eligible to receive federal or University aid.

- If you are taking required pre-requisite coursework, your department chair or admissions director may be able to complete a pre-requisite form to consider you for aid.

- If you have an approved form, you must be enrolled in at least six credit hours and will only be considered for loan eligibility.

- Enrolled at more than one institution

- You may only receive aid at one institution at a time, at your home institution. Your home institution is defined as the school in which are admitted as a degree-seeking student and the school from which you will earn your degree.

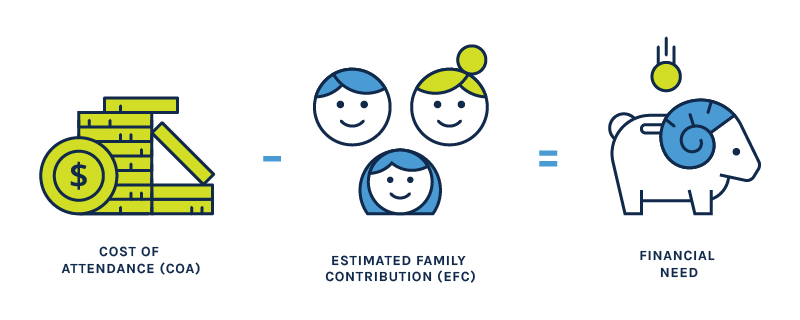

Determining financial need

UNC-Chapel Hill is committed to meeting the demonstrated financial need of our students.

To determine financial need, we first calculate your need using this process:

We work to meet the demonstrated financial need for first-degree, full-time students with aid in the form of grants, scholarships, loans and work-study from federal, state and University sources.

We use the CSS Profile to determine your eligibility for University grants. If your CSS Profile application does not show financial need, you will not be able to receive University grants, but you will be eligible for federal or state grants, along with loans and work-study, toward your demonstrated federal need.

For those seeking aid who do not have demonstrated financial need, we do automatically offer unsubsidized loan eligibility, though your total amount of aid from all sources cannot exceed the cost of attendance budget.

If you have demonstrated financial need and still need help financing your education, you may request additional unsubsidized loan funds or parent loans, as long as the total amount is still within your cost of attendance budget.