FAQs

Frequently Asked Questions (FAQs)

Use the menu below to filter your options based on the topic you are looking for. If you can’t find an answer to your question, please reach out and we will be happy to assist!

Aid eligible certificate programs are limited to:

- Radiography

Enrolled in a Teacher Certification Program

- Birth-kindergarten licensure program

If you are in a certificate program that is not listed above, you would not be eligible for federal financial aid.

Graduate and professional students do not qualify for the Federal and State grants that are available to undergraduate students. In some cases, graduate and professional students might qualify for awards through their department or school.

Yes, you will need to accept the loan(s) through your Connect Carolina Student Center. Then, complete the Master Promissory Note and Loan Entrance Counseling in your To-Do List.

Federal financial aid is not available to DACA students.

However, at Carolina DACA students can request Carolina Work-Study as long as they have eligible work authorization. They can apply to Carolina Works positions and earn work-study funds via a bi-weekly paycheck. Check out the request form to learn more.

Yes, you must complete the FAFSA for each year of enrollment to be reviewed for student aid.

Graduate and professional students typically do not qualify for most scholarships offered to undergraduate students. In some cases, graduate and professional students might qualify for awards through their department or school.

Residency is handled through the University Registrar’s office. You can read about residency on the registrar’s website.

Graduate/professional students apply for financial aid by completing the FAFSA. In some cases, you may be asked to provide additional information or documentation. Requested information will be posted on your Connect Carolina Student Center page.

Ask your Study Abroad Advisor if your program requires a visa letter. If yes, email fa_studyabroad@unc.edu to ask for one.

UNC-Chapel Hill is committed to meeting the demonstrated financial need of students.

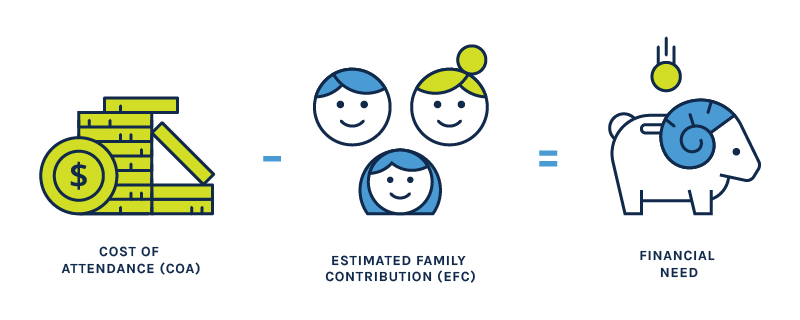

To determine financial need, we first calculate your need using this process:

We work to meet the demonstrated financial need for first-degree, full-time students with aid in the form of grants, scholarships, loans and work-study from federal, state and University sources.

We use the CSS Profile to determine your eligibility for University grants. If your CSS Profile application does not show financial need, you will not be able to receive University grants, but you will be eligible for federal or state grants, along with loans and work-study, toward your demonstrated federal need.

For those seeking aid who do not have demonstrated financial need, we do automatically offer unsubsidized loan eligibility, though your total amount of aid from all sources cannot exceed the cost of attendance budget.

If you have demonstrated financial need and still need help financing your education, you may request additional unsubsidized loan funds or parent loans, as long as the total amount is still within your cost of attendance budget.

Approximately 200 academic scholarships are awarded annually to qualified first-year, incoming students by the Office of Scholarships and Student Aid.

Occasionally, students may be considered for multiple academic scholarships, however they may only accept one non-need-based award from the university.

You may qualify for a waiver based on eligibility in the College Board system. If you don’t qualify and are unable to get a waiver through your high school, please reach out to us at aidinfo@unc.edu with your name, a brief statement explaining your hardship, and if possible, a copy of your SAR (student aid report) from completion of your FAFSA.

You can complete the budget increase request form as long as you have enrolled in the student health plan. You will need to provide the confirmation number you received when you enrolled in the plan.

Carolina students can receive aid for UNC Online courses that count towards degree requirements and are part of your Carolina enrollment for the semester. Visiting students are not eligible for aid for UNC Online courses and should check with their home schools to see if financial aid is available.

We will calculate if you are required to return any financial aid based on the date you withdraw. For more information regarding withdrawal, please see here.

ETS now directly administers the fee reduction program, you can find information on obtaining the fee reduction on the ETS website.

Print an official award letter on University letterhead from your Student Center in Connect Carolina. For information about viewing your award letter, you can view a short video that may be helpful.

Many programs share additional required expenses with our office, and we may have already taken this into account for you. You can view what is included in your budget in Connect Carolina under ‘student financials,’ and select ‘view financial aid.’ Please reach out to us with any questions regarding your budget.

You may be able to get additional financial aid through reconsideration. You will need to review and complete the Needs Analysis Form to begin the reconsideration process. You can read more about this process on our Aid Reconsideration page.

The amount of aid in your budget for housing will remain the same whether you live on or off-campus. The only time housing will not be included in your cost-of-attendance budget is if you are living at home with your parent(s). Your aid will go towards your bill with the University, and without the presence of a housing charge, your refund or amount owed may change. Use our budgeting calculator to see how the change may impact you.

It will depend on timing. If you drop the class prior to our office checking final enrollment (census date), you may owe back a portion of your aid.

Yes, we can adjust your budget, and if eligible for additional aid with the budget increase, your financial aid offer. Please email us to let us know about this change so we can update your record.

Only Permanent Residents or citizens of the United States are eligible for federal and institutional funds. Follow the guidance on the FAFSA website to determine your eligibility status. International students are expected to be self-funded and able to cover their educational costs for the entirety of their studies.

The Morehead-Cain Scholars Program and The Robertson Scholars Program are two of the most prestigious and dynamic undergraduate scholarship programs in the United States, and UNC is privileged to have their presence here. For more information, please go directly to their websites.

Academic scholarships are offered only to incoming first-year students. These scholarships are rare, very competitive, and depleted after first-year awards. Those not receiving academic scholarships in their first year might research possible outside sources of funding. Or, visit the UNC-Chapel Hill Office of Distinguished Scholarships and Honors Carolina, both located in the James M. Johnston Center for Undergraduate Excellence, to research potential scholarship awards.

Funding in the form of tuition or fee awards and non-service awards are considered a form of financial aid and will be included as part of your total financial aid offer. In no case will the total amount of financial aid exceed the financial aid cost of attendance. Thus, student loans may be reduced to prevent an over award of aid.

Sign up for Direct Deposit through the Cashier’s Office. If your financial aid covers all charges and there is extra funding, it will be deposited into your bank account to use as needed while you’re abroad.

There is no separate application. All incoming first-year and transfer students are evaluated for eligibility. You can read more about the eligibility guidelines here.

There is not a separate application to be considered for academic scholarships. You simply apply to the university and you will be evaluated for scholarships based on the holistic review. These scholarships are highly competitive and only roughly 7% of incoming students will receive a scholarship not based on financial need.

Contact our office to see if you have any remaining loan eligibility. You can also pursue private loans, if you have room in your cost-of-attendance budget. Another option may be to set up a payment plan with the University Cashier’s office. You can find information regarding payment plans on their website.

The Covenant FAQ page may have an answer to your question that wasn't addressed here.

We are typically informed when a student’s residency changes, however, it doesn’t hurt to be proactive. Feel free to email us and let us know, so we can make sure your budget is adjusted accordingly.

Contact the the University Cashier’s office for assistance with all billing related questions.

Holds are placed for a variety of reasons, and the action you take will be determined by the type of hold. You may experience a hold if you are selected for verification after your aid has been offered. In this case, complete your ‘To Do’ items in ConnectCarolina and wait until verification is complete. You also may have a hold if you were awarded aid based on full-time enrollment and are not yet enrolled in 12 credit hours. Once you are enrolled full-time, or if you let us know you have an approved underload, the hold will be removed. You may also have a hold if you are on SAP probation and haven’t submitted and received an approved appeal.

To continue to receive financial aid under the Carolina Covenant after the first year, a Scholar must:

- Meet current income/financial need requirements;

- Be enrolled at Carolina and making steady progress toward a degree;

- Be in compliance with federal financial aid standards and related institutional policies; and

- Meet the March 1 priority application deadline for financial aid.

If you’d like to be considered for financial aid, submit the FAFSA and CSS Profile so that we can determine your aid eligibility.

You may be eligible for additional loan funding to help replace your work-study award.

If you have been offered financial aid you may have the option to defer your bill. For more information, please visit the cashier's website.

Your financial aid eligibility will be determined by your program costs, and will be adjusted accordingly. You may receive less financial aid as a result of lower program costs.

Half-time enrollment for the academic year is defined as 6 hours for undergraduate, and 4.5 hours for graduate/professional school enrollment. If you are enrolled in less than half-time you are not eligible for federal loan programs. Additionally, if you drop below half-time enrollment borrowed loans can begin to go into repayment.

Since scholarship criteria for academic scholarships vary depending on the scholarship, awards are not subject to a minimum SAT score or class rank. However, due to the limited number of academic scholarship awards, and given the selectivity of the University, competition for academic scholarships is very stiff. Recipients tend to be at the top of their high school classes and have strong test scores, though these two elements alone do not guarantee an academic scholarship.

Typically, additional loan funding is available to help pay for more expensive programs. Some scholarships are awarded through the Study Abroad Office or other departments on campus.

If you have graduated with a bachelors degree and are pursuing a second bachelors degree you are considered a second-degree student. If you have completed all coursework required for an undergraduate degree and are eligible to graduate you would also be classified as second-degree when applying for future aid. For example, programs like the ABSN (Accelerated Nursing) program require an undergraduate degree which means you would be second-degree when applying for aid. Second-degree students are only eligible for federal loans or to pursue private loan options. Loan eligibility will be based on what you have borrowed as an undergraduate student, and when looking at loan limits, you would reference the chart here for third-year and beyond undergraduate limit.

We encourage you to check with your department for scholarship/departmental funding opportunities by program as that process is not handled by our office.

The primary type of financial aid available is the Unsubsidized Direct Loan. Also, students might borrow through the Grad PLUS program, if necessary, to fund the cost of education.

The University offers both academic and need-based scholarships.

- Need-based aid is based on a student’s financial situation. Students with financial need are also, of course, considered for academic scholarships.

- Academic awards are based on academic excellence, extracurriculars, and other factors outside of financial need. University-administered academic scholarships are awarded based on a holistic review of each student’s application to Carolina.

Federal Direct Loans (Subsidized, Unsubsidized, and Grad PLUS) and UNC Loans have a grace period 6 months from:

- the date of your graduation, OR

- the date you drop below half-time enrollment, OR

- the date you withdraw from school.

Before it is time to start repayment, you will receive a repayment schedule from your federal loan servicer for federal loans that tells you the total amount borrowed, current interest rates, due dates for payments, and total you will pay over the life of the loan if you follow the schedule. You can estimate your monthly repayment amounts using online loan repayment calculators. CFNC, FinAid.org, and the Federal Student Aid website are among some of the sites offering calculators. Be sure to check with your loan servicer for the various types of payment options, deferments, or loan cancellation available for your particular type of loan. UNC Loans are repaid to ECSI, the loan servicer. You can learn more about repayment on their website.

The University has two admissions deadlines — a non-binding Early Action deadline, and the regular decision deadline.

If you are offered an academic scholarship, this offer will display in the decision tab of your MyCarolina at the same time your admissions decision is available. For details on when you will receive your admissions decision, please visit the undergraduate admissions website.

(Note: The Morehead-Cain and Robertson Scholars are run by independent foundations. Visit their websites for detailed information about deadlines and notifications.)

Due to federal regulations, financial aid cannot be disbursed earlier than seven-to-10 days before the first day of classes. Once disbursed, it will be applied directly to your bill with the University Cashier’s office. If your bill is covered, and you are left with a credit, it will be processed into a refund, which is typically issued during the first week of classes. Setting up direct deposit with the University Cashier’s office will help you get your refund faster. Double check to make sure all anticipated financial aid has been applied before contacting them.

If you are in need of financial assistance, we would like to help. Please visit our COVID-19 Financial Assistance Page for robust information regarding types of assistance and for additional FAQ's.

The University Cashier’s office handles the processing of the 1098-T. You can get instructions on how to find that information on their website.

There is no separate application to be considered for the Pogue Scholarship. Outstanding applicants to UNC-Chapel Hill who have demonstrated high academic achievement, commitment to diversity issues, and engagement in matters of inclusion are given special review by the Admissions Office and the Office of Scholarships and Student Aid for this scholarship.

You may find more about the Pogue Scholarship by emailing academic_scholarships@unc.edu.

Please feel free reach out to our office! You can email us at fa_studyabroad@unc.edu or call 919.962.8396.

Changes in aid can happen for several reasons. First, check your financial aid applications to make sure there aren’t any errors in the information you provided. Change in aid can also happen due to a change in your financial situation. If you have new assets, or an increase in income, this can decrease your financial need. If the number of people in your household changes, or number in college changes, your need can also change. Your estimated family contribution (EFC) is divided among the number in college, so if you have a sibling who graduates, your EFC can change.

UNC no longer participates in offering college-sponsored scholarships to National Merit finalists.

We will never identify you without your permission. The names of Covenant Scholars may be released to Carolina faculty and staff who have a legitimate educational interest, as defined by the Family Educational Rights and Privacy Act (FERPA). Otherwise, the identification of Covenant Scholars will not be disclosed without the student’s permission.

Students who receive financial aid under the Covenant will be tracked in the University’s financial aid system, but their identities are protected, in keeping with Carolina’s confidentiality policies regarding the disclosure of personal information.